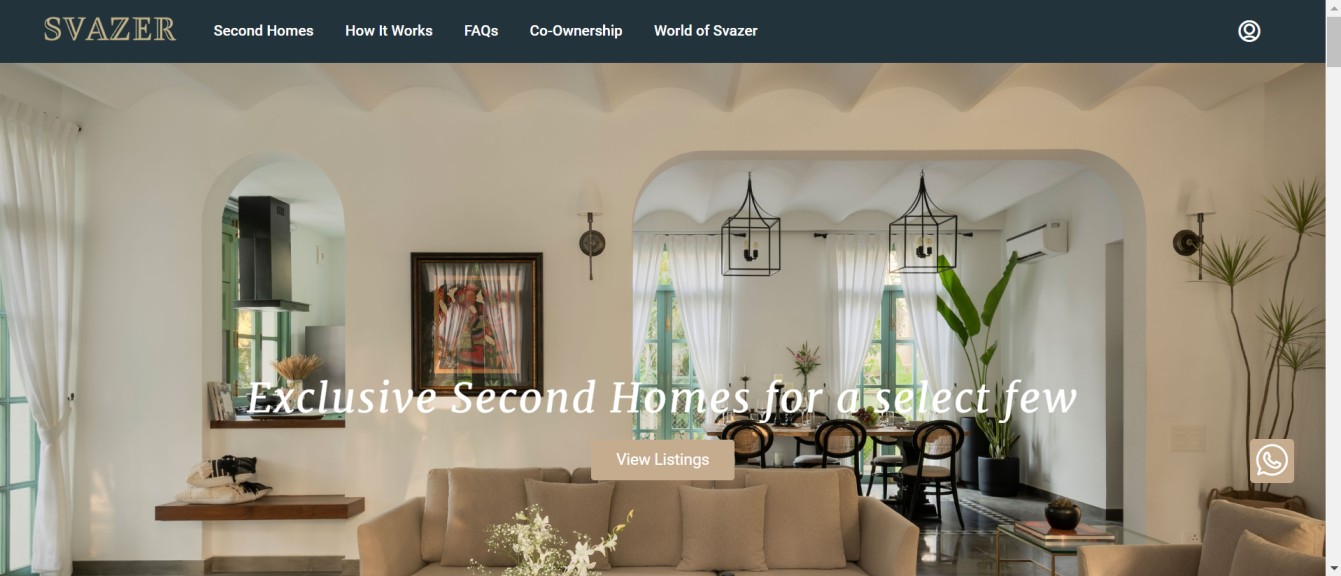

Svazer offers luxury second home co-ownership, allowing up to eight people to share ownership of high-end vacation properties in prime global locations like Dubai, Goa, and Sri Lanka. The service includes flexible booking through an AI-driven app, managed services for hassle-free stays, and the option to rent out the property for additional income. Svazer’s model emphasizes equity building, convenience, and memorable experiences for co-owners.

The luxury real estate market has evolved significantly over the past decade, with innovative ownership models emerging to cater to the changing needs of affluent consumers. One of the most intriguing developments is the rise of luxury second home co-ownership, a concept that allows multiple individuals to share the ownership of high-end vacation properties. This model offers an attractive alternative to traditional real estate investment, combining the benefits of owning a luxury home with the cost efficiency and convenience of shared ownership. Companies like Svazer are at the forefront of this trend, redefining how luxury properties are accessed and enjoyed.

The Concept of Luxury Co-Ownership

Luxury co-ownership is a real estate model that allows multiple individuals to share ownership of a high-end property, typically in a desirable vacation location. This model divides the cost, responsibilities, and time spent at the property among co-owners, making luxury real estate more accessible. Each co-owner holds an equity stake in the property, which can appreciate over time, and they benefit from flexible usage schedules. Managed services, often facilitated by companies like Svazer, ensure that maintenance, bookings, and other logistical aspects are taken care of, providing a seamless ownership experience.

In this model, the property is typically owned by an LLC or a similar legal entity, with each co-owner holding a share of the company, corresponding to their ownership stake in the property. This structure provides a level of protection and clarity in terms of legal rights and responsibilities.

Co-ownership offers significant financial advantages, especially when compared to sole ownership of a luxury property, which often remains unoccupied for much of the year. By sharing the costs of purchase, maintenance, and management among several owners, co-ownership makes it possible to enjoy the benefits of luxury living without the full financial burden. Additionally, the ability to rent out the property when it is not in use can provide an additional income stream, further offsetting costs.

The co-ownership model is also highly flexible. Most arrangements allow owners to schedule their stays through a centralized booking system, often managed by an AI-driven app. This ensures that the property is used efficiently and that all co-owners have access during their preferred times. The centralized management also handles routine maintenance, cleaning, and other services, ensuring that the property is always in top condition, ready for the next visit.

In essence, luxury co-ownership combines the best aspects of luxury property ownership with the convenience and cost-effectiveness of shared resources. It democratizes access to high-end real estate, allowing more people to enjoy the benefits of owning a second home in a prime location without the associated hassles and expenses.

Benefits of Co-Ownership

Co-ownership of luxury properties presents a range of benefits that make it an attractive option for those looking to invest in high-end real estate without bearing the full financial burden. Here’s a closer look at some of the key advantages:

1. Cost Efficiency

One of the most significant benefits of co-ownership is the ability to enjoy a luxury property at a fraction of the cost. Purchasing a second home in a prime location, whether it’s a beachfront villa or a mountain retreat, typically involves a substantial investment. By sharing ownership with others, the upfront cost is significantly reduced, allowing more people to afford the lifestyle associated with owning a luxury home. Co-owners split not only the purchase price but also ongoing expenses such as maintenance, taxes, and insurance, making the financial commitment more manageable.

2. Equity Building

Unlike timeshares, where buyers purchase the right to use a property for a specific period without gaining ownership, co-ownership provides an equity stake in the property. This means that as the property appreciates in value, so does the owner’s share. Co-owners can benefit from the potential increase in property value over time, which can lead to substantial financial gains when the property is sold or if an owner decides to sell their share. This equity-building aspect makes co-ownership a smarter long-term investment compared to other shared vacation models.

3. Hassle-Free Ownership

One of the key advantages of co-ownership is the convenience it offers. Luxury properties require regular maintenance and management, which can be time-consuming and stressful for individual owners. Co-ownership models typically include managed services, where a professional company handles all aspects of property care, including cleaning, repairs, landscaping, and even concierge services. This means that co-owners can enjoy the property without worrying about the day-to-day responsibilities of upkeep, ensuring that their time spent at the property is truly relaxing.

4. Flexible Usage

Co-ownership arrangements often come with flexible booking systems that allow owners to reserve the property during their preferred times of the year. Many co-ownership models utilize an AI-driven app or a similar platform to manage bookings, ensuring that each owner has fair access to the property based on the terms of their agreement. This flexibility is particularly appealing to those who want the freedom to vacation on their schedule without the restrictions typically associated with timeshares.

5. Access to Multiple Properties

In some co-ownership models, owners may have access to a portfolio of properties rather than being tied to just one location. Companies like Svazer offer opportunities to invest in multiple luxury homes across different destinations, providing variety and a broader range of experiences. This diversified approach allows co-owners to enjoy vacations in different settings—be it a beach in Goa, a cityscape in Dubai, or a serene retreat in Sri Lanka—without having to purchase separate properties in each location.

6. Sustainable and Eco-Friendly

The shared ownership model is inherently more sustainable than traditional vacation home ownership. By sharing a property with others, co-owners reduce the need for additional development and resource consumption that comes with building and maintaining multiple homes. Many co-ownership companies also incorporate eco-friendly practices into their property management, ensuring that luxury living can be enjoyed with a lower environmental impact. This focus on sustainability is increasingly important to modern consumers who are conscious of their environmental footprint.

7. Rental Income Potential

When not using the property, co-owners often have the option to rent out their time slots, generating additional income. This can help offset the costs of ownership and even turn the property into a profitable venture. The rental management is typically handled by the same company that oversees the property, ensuring that the process is seamless and hassle-free for the owners. This potential for rental income adds another layer of financial benefit to the co-ownership model, making it an even more attractive investment.

8. Sense of Community

Co-ownership fosters a unique sense of community among owners. Unlike traditional ownership, where the property may sit empty for long periods, co-owned properties are often part of a network of like-minded individuals who share a common interest in the property and its location. This can lead to new friendships, networking opportunities, and a sense of belonging that extends beyond just owning a piece of real estate. For those who value social connections and community, co-ownership can provide an enriching experience that enhances the enjoyment of their luxury property.

9. Lower Financial Risk

Investing in a luxury property can be risky, especially in markets that are prone to fluctuations. Co-ownership allows individuals to spread this risk among multiple parties. If the market takes a downturn, the financial impact is shared among co-owners, reducing the burden on any single individual. This risk-sharing aspect makes co-ownership a more secure way to invest in luxury real estate, particularly for those who are cautious about making large financial commitments in a volatile market.

10. Long-Term Value and Legacy

For many, owning a luxury property is not just about immediate enjoyment but also about creating a lasting legacy. Co-ownership allows individuals to pass down their share of the property to future generations, ensuring that the property remains within the family. This can be an appealing way to build a long-term asset that grows in value and can be enjoyed by children and grandchildren. The managed aspect of co-ownership ensures that the property remains well-maintained, preserving its value and appeal over time.

Challenges and Considerations

-

Legal Complexities: Potential legal hurdles and how companies like Svazer navigate them.

-

Scheduling Conflicts: Managing the use of the property among co-owners.

-

Maintenance and Upkeep: Ensuring high standards are maintained across different owners’ use.

Market Trends and Future Prospects

-

Growth in Demand: Analyzing the increasing demand for luxury second homes in prime locations.

-

Technological Integration: How AI and other tech innovations are revolutionizing the co-ownership experience.

-

Sustainability and Eco-Luxury: The role of eco-friendly practices in the luxury segment.

Conclusion

-

The Future of Luxury Real Estate: Reflecting on how co-ownership could shape the future of luxury vacationing.

-

Svazer’s Position in the Market: How Svazer is setting itself apart in the competitive landscape.