The global aeroderivative gas turbine market size is projected to grow at a CAGR of 4.2% between 2025 and 2033. This steady growth reflects the increasing demand for energy-efficient and flexible power generation solutions across various industries. As the world moves toward cleaner and more sustainable energy, aeroderivative gas turbines are becoming integral to modernizing power generation infrastructure, providing solutions that offer both operational efficiency and environmental benefits.

Introduction to Aeroderivative Gas Turbines

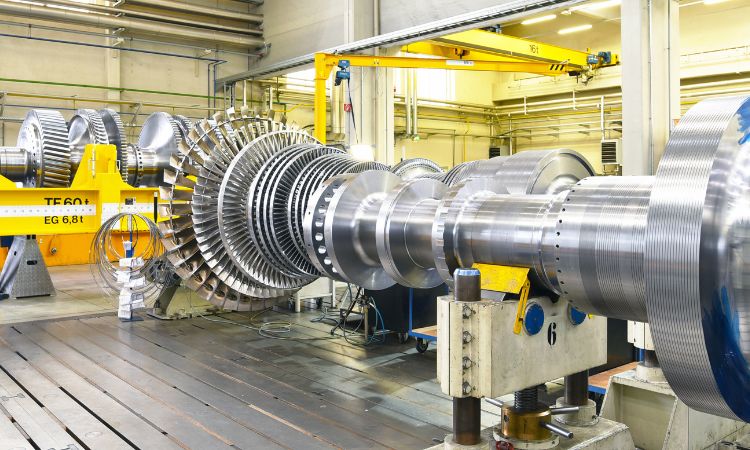

Aeroderivative gas turbines, a critical technology for efficient power generation, are known for their high flexibility, fast start-up times, and efficiency in various industrial applications. Derived from jet engine technology, these turbines offer a lighter, more compact alternative to traditional heavy-duty gas turbines, making them highly valuable for both power generation and backup energy solutions.

The growth in global energy demand, coupled with the rising need for cleaner and more efficient power generation, is driving the adoption of aeroderivative gas turbines across different sectors. The market is also witnessing an increased focus on reducing emissions and achieving energy sustainability, leading to a growing preference for these turbines due to their ability to operate efficiently and with lower environmental impact.

Market Segmentation of the Aeroderivative Gas Turbine Industry

The aeroderivative gas turbine market is segmented by technology, cycle type, sector, capacity, and region. Each of these segments plays a key role in shaping the growth trajectory of the market.

By Technology

-

Aeroderivative Gas Turbines: These turbines are designed to provide high efficiency, fast start-up times, and low operational costs. Aeroderivative turbines are ideal for industries requiring rapid responses to fluctuating power demands. They are also capable of working efficiently at partial load conditions, making them an essential part of modern power plants.

-

Light Industrial Gas Turbines: Light industrial turbines are smaller than aeroderivative turbines, making them suitable for medium-scale industrial applications. These turbines offer good efficiency and durability for industries that do not require the heavy-duty capacity of larger turbines but still need reliable and cost-effective power generation.

-

Heavy Duty Gas Turbines: Heavy-duty turbines are designed for large-scale power plants and can provide the high output necessary for major industrial operations. While aeroderivative turbines are often favored for their flexibility, heavy-duty turbines remain popular in long-term, stable power generation settings.

By Cycle Type

-

Simple Cycle: Simple cycle turbines generate power by using exhaust gases directly to drive a generator. While they have lower efficiency compared to combined cycle systems, they offer the advantage of quick start-up times and relatively low capital costs. Simple cycle turbines are especially popular in regions where peak load power generation is required or in remote locations with limited infrastructure.

-

Combined Cycle: Combined cycle turbines utilize both gas and steam turbines to generate electricity, offering significantly higher efficiency levels. These turbines can operate at high temperatures and use the waste heat from the gas turbine to generate steam for the steam turbine, increasing overall energy efficiency. Combined cycle systems are increasingly used in utility-scale power plants to maximize power generation while minimizing fuel consumption.

By Sector

-

Manufacturing: Aeroderivative gas turbines are crucial in industries where energy is used continuously for production processes. They provide reliable, on-demand power, supporting manufacturing operations in sectors such as chemicals, metals, and textiles. As manufacturing facilities look to reduce energy costs and improve sustainability, aeroderivative turbines are becoming an increasingly important part of their energy mix.

-

Oil and Gas: The oil and gas sector has long relied on gas turbines for various applications, including electricity generation at offshore rigs, pipeline compression, and refinery operations. The flexible and compact nature of aeroderivative turbines makes them ideal for use in these applications. Additionally, as the oil and gas industry faces increasing pressure to adopt more environmentally friendly technologies, aeroderivative turbines offer a low-emission, high-efficiency solution.

-

Electric Power Utility: Electric utilities are embracing aeroderivative turbines to help meet rising energy demands and improve grid reliability. These turbines are often used in peaking plants, which help balance supply and demand during periods of high electricity consumption. Additionally, they are critical in combined cycle plants, where they work alongside steam turbines to produce more power with fewer emissions.

By Capacity

-

Upto 1 MW: Small-scale aeroderivative turbines, with capacities of up to 1 MW, are ideal for use in remote locations, backup power generation, and smaller industries that need a cost-effective solution for continuous power generation. This market is expected to see steady growth as demand for decentralized power generation solutions increases.

-

1 – 30 MW: Mid-capacity turbines offer a balance between size and performance, making them suitable for medium-sized industrial applications and small-to-medium power plants. These turbines are increasingly being deployed in combined cycle configurations, providing an efficient and reliable solution for medium-scale power needs.

-

30 – 70 MW: Larger turbines with capacities between 30 MW and 70 MW are typically used in utility-scale power plants and large industrial applications. They provide the necessary power for industries with significant energy requirements, such as chemical plants and large manufacturing facilities.

-

Above 70 MW: High-capacity turbines above 70 MW are used primarily in large-scale power plants and combined cycle plants where maximum energy output is required. These turbines are expected to see continued growth, particularly as global electricity demand increases and as countries look for more sustainable and efficient energy solutions.

Regional Analysis

North America

North America, particularly the United States and Canada, continues to be a key market for aeroderivative gas turbines. The increasing focus on clean energy and the need for reliable, flexible power generation are driving the demand for these turbines. In addition, government incentives and policies aimed at reducing carbon emissions and improving energy efficiency are further supporting the market.

Europe

Europe has been at the forefront of adopting renewable energy technologies and improving energy efficiency. Aeroderivative gas turbines are increasingly being used in Europe’s power plants, where they complement renewable energy sources such as wind and solar power. The EU’s focus on reducing greenhouse gas emissions is further propelling the demand for more efficient and low-emission turbines.

Asia-Pacific

Asia-Pacific, particularly China and India, is witnessing rapid industrialization and urbanization, driving the demand for reliable and efficient power generation solutions. As the region moves toward cleaner energy solutions, aeroderivative gas turbines are expected to play a significant role in modernizing power generation infrastructure. These markets are poised for substantial growth, driven by increased energy demand and government investments in energy infrastructure.

Rest of the World

The market for aeroderivative turbines is also growing in other regions, including Latin America, the Middle East, and Africa. As developing countries work to expand their energy access and improve grid reliability, the flexibility and efficiency of aeroderivative gas turbines make them an attractive option for a variety of applications.

Competitive Landscape

The aeroderivative gas turbine market is highly competitive, with several key players such as General Electric (GE), Siemens Energy, Mitsubishi Power, and Ansaldo Energia. These companies are focused on technological innovation to improve turbine efficiency, reduce emissions, and integrate renewable energy sources. Collaborations, partnerships, and strategic acquisitions are common in this market as companies look to expand their product offerings and geographic reach.